District employees have access to a new and exclusive financial wellness program: Financially Fit DC at Work!

Financially Fit DC at Work convenes all the benefits, services, tools and training available to District Government employees and their families, such as:

- Retirement Option and Plans

- DC College Savings Plan

- DC Unclaimed Property

- Employee Assistance Program

- Home Purchase Assistance Program (HPAP)

Financially Fit DC at Work is part of the National Association of State Treasurers grant award to promote financial literacy education to District employees.

Join now and see all the benefits and programs available to you: Financially Fit DC at Work.

Did You Know

After you register, you can take the opportunity to win prizes* by completing different activities along your financially fit journey, such as:

- Complete an employee survey at AtWork.FinanciallyFitDC.com.

- Attend a Retirement Plans seminar by registering at www.DCRetire.com or by clicking here.

- Making Your Money Last in Retirement

- Investing in Volatile Markets

- 529 Savings Plan

- Attend one of the Open Enrollment webinars with MissionSquare or DISB. You can join the webinars through: https://dchr.dc.gov/node/1505396.

- Register for Virtual one-on-one appointment with your local Retirement Plans Specialist. To schedule an appointment, go to www.DCRetire.com and click on register under “Appointments” or by clicking here.

-

Register and complete an intake questionnaire at AtWork.FinanciallyFitDC.com. Complete registration and intake questionnaire will give you one (1) entry.

-

Earn Discovery Badge at AtWork.FinanciallyFitDC.com. Earn a Discovery Badge to receive one (1) entry.

-

Attend a virtual online seminar. Each session attended will give you one (1) entry.

-

Attend a Virtual one-on-one appointment with your local Retirement Plans Specialist. A completed appointment gives you one (1) entry.

-

Two (2) Apple iPad Grand-Prizes

-

Ten (10) Apple AirPods

-

Twenty-Five (25) $50 Gift Cards

-

Twenty-Five (25) $25 Gift Cards

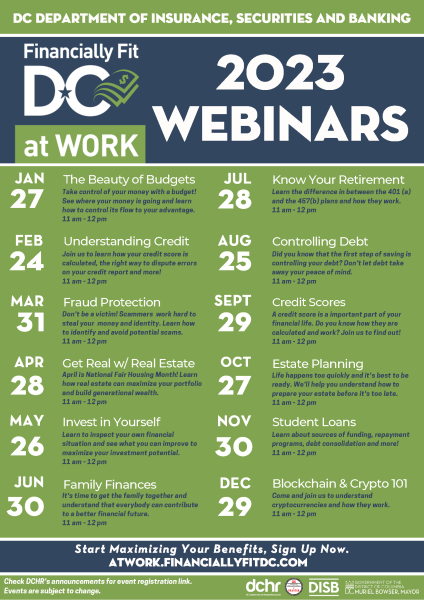

January's Event: The Beauty of Budgets

Register Now

- Friday, January 27, 2023

- 11:00 AM - 12:00 PM (UTC-04:00) Eastern Time (US & Canada)

- Download and share the event flyer.

Upcoming Events

Do not miss an opportunity to find new and different opportunities to plan for a secure financial future. Participate in as many events possible this year to maximize your financial wellness.

* Download the full list of events by clicking on the image above.

Additional Resources:

Percipio Resources

- Common Sense Finance: Finance for Individuals and Entrepreneurs

- The Tools & Techniques of Employee Benefit and Retirement Planning, 12th Edition

MissionSquare Retirement Education Center: Retirement Education Center

Other MissionSquare Resources

- How to Pay off Debt

- Saving for Retirement Worksheets

- Social Security Decisions

- Match a Roth IRA with your 457 Plan

- Market Risk and Return

- Market Volatility

- Rebalance Your Investments to Manage Risk

- Critical Ages for Retirement Planning

Budgeting & Organizing your Finances

- Juggling Your Financial Goals (MissionSquare webinar)

- Building your Investment Portfolio (MissionSquare webinar)

- Student Loan Paydown (MissionSquare webinar)

- 401a & 457b Educational Seminar (MissionSquare webinar)

How to Plan for your Retirement

- Your Retirement Plans Work Together (MissionSquare webinar)

- Estate Planning (MissionSquare webinar)

- Social Security (MissionSquare webinar)

Outside Resources:

How to Plan for your Retirement:

Article: 5 Common Retirement Planning Mistakes -- And How To Avoid Them by Kelli Click

Budgeting & Organizing your Finances:

Taxes: https://www.key.com/personal/financial-wellness/taxes.jsp

Article: 12 Easy Ways to Pay off Debt