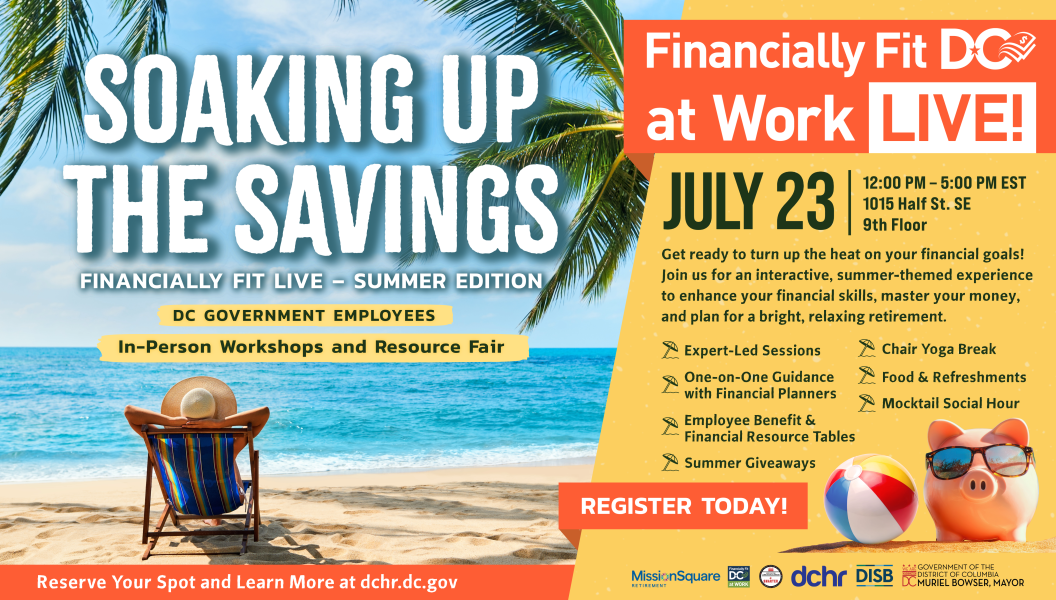

Welcome to Soaking Up The Savings:

Financially Fit Live – Summer Edition

DC Government Employee In-Person Workshops and Resource Fair

Get ready to turn up the heat on your financial goals! Join us for an interactive, summer-themed experience to enhance your financial skills and plan for a bright, relaxing retirement.

DC Government Employees are invited to get face-to-face advice from financial experts, direct access to benefit resources, and learn effective strategies and tips to help you master your money, from budgeting and saving to investing and planning for the future.

What You'll Get

Expert-Led Sessions

One-on-One Guidance with Financial Planners

Mocktail Social Hour

Summer Giveaways

Employee Benefit Tables

Financial Resource Tables

Chair Yoga Break

Food & Refreshments

Secure your spot today and take the steps to mastering your money and getting the retirement you deserve.

DID WE MENTION WE'LL BE RAFFLING GIFT CARDS EACH SESSION?

*Attendance prizes will be raffled after each session, and employees must be present to win.

*Employees are only eligible for one prize during this event.

IN-PERSON EVENT

July 23, 2025

12:00 PM - 5:00 PM EST

Thank you so much for your interest in today’s Financially Fit DC event. We’re currently at full capacity and won’t be able to accept walk-ins. We truly appreciate your enthusiasm—please stay tuned for future events and opportunities.

Please Note:

Employees are welcome to drop in for specific sessions or attend the entire event.

Employees must work with their managers for approval.

Location

District of Columbia Department of Human Resources

1015 Half Street, SE, Washington, DC 20003

9th Floor | Rooms: 9013, 9014, 9015, 9016, 9017, 9019, 9025, 9026

Parking and Metro Access:

Parking in and around our building is limited.

The closest metro is within two blocks, Navy Yard – Ballpark metro station

(Baseball Stadium exit), which is on the green line.

Full Agenda

|

Time

|

Workshops & Activities

|

Room

|

|---|---|---|

|

12:00 pm |

Check-in & Vendor Tables |

Main Reception Area & |

|

12:30 pm – Session I |

Market Volatility |

Rooms 9016-9017 |

|

1:20 pm – Session II |

Retirement Fundamentals |

Rooms 9016-9017 |

|

1:20 pm – Session II |

Ready, Set, Retire! (For Employees 0-5 Years from Retirement) |

Rooms 9014-9015 |

|

2:05 pm – Wellness Break |

Chair Yoga |

Room 9013 |

|

2:45 pm – Session III |

Estate Planning |

Rooms 9016-9017 |

|

2:45 pm – Session III |

ABCs of Investing |

Rooms 9014-9015 |

| 1:30 pm – 4:15 pm | 15-Minute One-on-One Conversations with Certified Financial Planners (CFP) Please note: Signing up is required on the day of the event. |

Rooms 9025-9026 |

| 12:00 pm – 5:00 pm | Refreshments | CLD Main Breakroom & Kitchen |

|

3:30 pm – 5:00 pm |

Vendor Tables |

Reception Area & |

|

4:00 pm – 5:00 pm |

Mocktail Social Hour |

CLD Main Breakroom & Kitchen |

About

Join the Department of Human Resources (DCHR), the Department of Insurance, Securities, and Banking (DISB), and the Office of the Chief Financial Officer (OCFO) for an interactive Financially Fit DC at Work in-person workshops and resource fair on financial concepts designed to help District of Columbia Government employees achieve their financial goals.

The event is free and is open to all District of Columbia Government employees.

|

Here's what to expect: Expert Guidance Resource Connections Practical Strategies |

|

Why Attend? • Gain confidence in managing your finances • Get direct access to Certified Financial Planners • Discover new ways to achieve your financial goals • Network with like-minded individuals • Receive free financial resources and materials |

Resource Vendors

Participating Resource Vendors:

TIAA (Teachers Insurance and Annuity Association of America)

DISB (Financially Fit DC At Work)

DCHR (DC Government Employee Benefits and Retirement Program)

MissionSquare Retirement

AFLAC (Indemnity Plans)

Standard Insurance Company (Disability/Group Life Insurance)

OCFO (Unclaimed Property)

529 Plan

DC Credit Union

Aetna

CareFirst

Kaiser Permanente

United Healthcare

Cigna

Contact

For more information, please email [email protected].